Nouriel Roubini's hot-rod is one of the few beneficiaries of the global economic crisis. Because he warned of this mess for so many years he was derisively tagged "Doctor Doom" by some. I even came across that old saw about "even a stopped clock is correct twice a day." But what the world is experiencing is not one of your everyday "downs," as in ups and downs.

Now they're paying attention.

When I first heard that descriptive term "dead cat bounce" in September it became clear that these are not normal times.

So tracking the RGE output is like watching a sparkler on a dark night. Like everyone else they put out a lot of pretty lights, but we're gonna have to wait til the fireworks is over before things get back to normal. Er..., whatever the new "normal" might be.

§

§

James Kwak points to a blurb in The Economist by Anthony Gottlieb reflecting on a now-lost interview with "Bernie" Madoff. Don't you just love how everyone always uses that term of endearment instead of his actual name, Bernard?

I had gone to talk with him about the impact of technology on employment in the finance industry. His market-making firm, Bernard Madoff Investment Securities, was said to be one of the most innovative in the use of electronic trading. So would more computers mean fewer finance jobs in the city? I remember his answer because it was counter-intuitive. No, he said, because these days so many compliance officers are needed to monitor and document the legality of transactions that there is more paperwork than ever. The net number of jobs would stay roughly the same.Mr Madoff gave no hint of any weariness with or hostility towards the burden of regulatory oversight. Perhaps this is because, as we now know, it was in fact too ineffective to cramp his style. But at the time he came across merely as calm, strikingly rational, devoid of ego, and the last person you would expect to make your wealth vanish. I certainly would have trusted him with my money.

It's hard to discern how much of credibility is just good PR.

Kinda like having a reputation of being an old-fashioned Methodist helps you out in the Oval Office.

§

§

Barry Ritholtz directs those who want to believe that "no one saw it coming" to a WSJ piece by Justin Lahart recalling one Raghuram Rajan, a professor at the University of Chicago's Booth Graduate School of Business. At a meeting of great minds in 2005 he was attacked as an "antimarket Luddite, wistful for old days of regulation."

Etc., etc.

...he had planned to write about how financial developments during Mr. Greenspan's 18-year tenure made the world safer. But the more he looked, the less he believed that. In the end, with Mr. Greenspan watching from the audience, he argued that disaster might loom.Incentives were horribly skewed in the financial sector, with workers reaping rich rewards for making money, but being only lightly penalized for losses, Mr. Rajan argued. That encouraged financial firms to invest in complex products with potentially big payoffs, which could on occasion fail spectacularly.

He pointed to "credit-default swaps," which act as insurance against bond defaults. He said insurers and others were generating big returns selling these swaps with the appearance of taking on little risk, even though the pain could be immense if defaults actually occurred.

Mr. Rajan also argued that because banks were holding a portion of the credit securities they created on their books, if those securities ran into trouble, the banking system itself would be at risk. Banks would lose confidence in one another, he said: "The interbank market could freeze up, and one could well have a full-blown financial crisis."

Two years later, that's essentially what happened.

I don't know how the University of Chicago is laid out, whether he and Barack Obama ever met and talked together somewhere along the way.

Let's hope so. They seem to share a precient intuitive streak.

(In defence of Mr. Greenspan, I recall his timeless reference to "irrational exuberance," although it fell on deaf ears at the time, both in Washington and New York, dismissed as yet another of Greenspan's opaque locutions.)

§

§

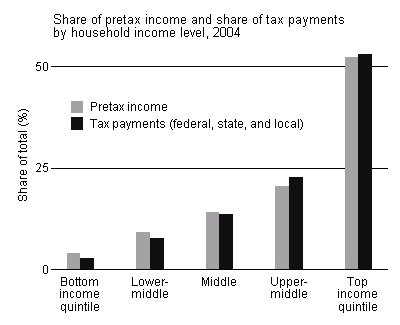

Finally, Mark Thoma picked up a link to Lane Kenworthy’s weblog that puts the notion of progressive taxation into a slightly different light.

I've listened for years as Neal Bootz here in Atlanta and others cut from Libertarian/Conservative/Republican cloth complain about the terrible price rich people must pay for hard work, good judgment and enterprising spirits -- all those admirable qualities that make America great. This chart and explanation puts the whole soak-the-rich anti-progressive tax arguments into another light.

The rates are higher for those with larger incomes. The implication is that our tax system is quite progressive.But it doesn’t make much sense to look only at federal taxes. State and local taxes account for about a third of total tax revenues, and they tend to be less progressive than federal taxes.

If we take into account all taxes — federal, state, and local — the effective tax rate for the well-to-do is only a bit higher than for the poor. Here is one way to see this, based on data from the CBO and the Tax Foundation.

No comments:

Post a Comment